Serinus Energy Inc. (“Serinus”, “SEN” or the “Company”), is pleased to report its financial and operating results for the three months ended June 30, 2017.

Q2 2017 Highlights

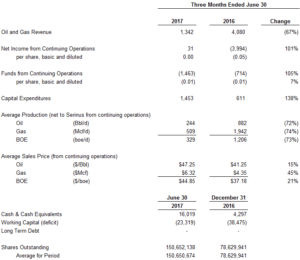

- During Q2 2017, production from Tunisia averaged 329 boe/d, a decrease from 1,206 boe/d in Q2 2016. Lower production during 2017 was due to the shut-in of fields in Tunisia. Chouech Es Saida field has been shut-in since February 28, 2017, due to labour issues. In addition, from May 22, 2017 the Sabria field was also shut-in due to continued social unrest in the southern part of the country. Both fields currently remain shut-in.

- The netback for Tunisia in Q2 2017 was $2.00 per boe, compared to $11.71 per boe in 2016. The lower netback was driven by lower production driving up costs on a boe basis.

- Funds from operations was an outflow of $1.5 million for Q2 2017 (2016: $0.7 million) comprised of a loss from operations in Tunisia of $1.0 million and a corporate loss from operations of $0.6 million, partially offset by funds from operations in Romania of $0.1 million, resulting in total negative funds from operations for the quarter. On a year to date basis, funds from operations was an outflow of $1.3 million, as compared to an inflow of $2.0 million in the comparative period of 2016. Funds from operations from Tunisia was $0.0 million and Romania $0.1 million, which when offset by the corporate loss of $1.4 million, resulted in negative funds from operations year to date. The sale of Ukraine in 2016 and lower production in Tunisia in 2017 contributed to the decrease in funds from operations.

- The net loss for the six month period ended June 30, 2017 was $2.1 million, compared to a net loss from continuing operations of $8.1 million in Q2 2016.

- On May 9, 2017, the Company signed an Engineering, Procurement, Construction and Commissioning Contract (“EPCC”) with Confind S.R.L., a Romanian company, for the construction of a gas facility and associated flowlines and pipelines for Moftinu development in Romania. Construction commenced in Q2 2017 with anticipated first gas in Q1 2018.

- At June 30, 2017, the Company was not in compliance with the consolidated financial debt to EBITDA ratio, the consolidated debt service coverage ratio and the Tunisian debt service coverage ratio on its debt held with EBRD. Subsequent to June 30, 2017, EBRD formally waived compliance with these ratios for the period ended June 30, 2017. The implication of this waiver is that the debt repayments will follow their original scheduled repayment terms and the bank will not be acting on its security as a result of the breach.

Notes: Serinus prepares its financial results on a consolidated basis. Unless otherwise noted by the phrases “allocable to Serinus”, “net to Serinus”, “attributable to SEN shareholders” or “SEN WI”, all values and volumes refer to the consolidated figures. Serinus reports in US dollars; all dollar values referred to herein, whether in dollars or per share values are in US dollars unless otherwise noted.

Summary Financial Results (US$ 000’s unless otherwise noted)

General & Financial Highlights

- Revenue, net of royalties, from Tunisia for the three and six months ended June 30, 2017 decreased to $1.2 million and $3.6 million, compared to $3.8 million and $7.0 million in the comparative periods of 2016. The decrease in 2017 was attributable to lower production, partially offset by higher commodity prices and lower royalty rates.

- Total royalties paid decreased from $0.5 million in Q2 2016 to $0.1 million in Q2 2017. Much of this decrease was due to lower production offset by higher average commodity prices.

- Serinus made capital expenditures of $1.5 million in Q2 2017, of which $1.4 million was expended in Romania and $0.1 million was expended in Tunisia.

- At June 30, 2017, the Company was not in compliance with the consolidated financial debt to EBITDA ratio, the consolidated debt service coverage ratio and the Tunisian debt service coverage ratio on its debt held with EBRD. Subsequent to June 30, 2017, EBRD formally waived compliance with these ratios for the period ended June 30, 2017. The implication of this waiver is that the debt repayments will follow their original scheduled repayment terms and the bank will not be acting on its security as a result of the breach. However, given the covenant was breached as at June 30, 2017, Serinus has reclassified its long-term debt to current in the financial statements, as required under accounting standards. There is a risk that the Company will continue to violate certain financial covenants relating to its debt held with EBRD, particularly given the current commodity prices and the shut-in of production in Tunisia. Although the EBRD has previously provided waivers for covenant breaches there is no certainty this will occur in the future. If these covenants are not met, the debt may therefore become payable on demand.

- In June 2017, the Company closed the sale of its indirect wholly owned subsidiary that held an interest in Syria Block 9, for which Force Majeure had been declared on July 16, 2012 due to conditions arising from the instability in the country. The impact of this sale was that payables in the amount of $2.2 million relating to this asset have been reversed through the income statement and presented as a gain on sale. This represents management’s ongoing initiative to strengthen the Company’s balance sheet through the divesture of non-core assets.

Operational Highlights

- During Q2 2017, production from Tunisia averaged 329 boe/d, a decrease from 1,206 boe/d in Q2 2016. Lower production during 2017 was due to the shut-in of fields in Tunisia. Chouech Es Saida field has been shut-in in since February 28, 2017, due to labour issues. In addition, from May 22, 2017 the Sabria field was also shut-in due to continued social unrest in the southern part of the country. Both fields currently remain shut-in.

- In Tunisia, the Company incurred $0.1 million of capital expenditures for the three month period ended June 30, 2017. In Romania, the Company incurred $1.4 million of capital expenditures for the three month period ended June 30, 2017. In Q2 2017 construction commenced on the Moftinu gas plant. Incurred costs included permitting and licencing, land rentals and ongoing engineering study costs as well as costs associated with the Bucharest office.

Outlook

The Company is focusing on Romania as the impetus for growth over the next several years. The Moftinu gas development project is a near-term project that is expected to begin producing from the gas discovery wells Moftinu-1001 and Moftinu-1000 in early 2018. The Company signed an EPCC contract on May 9, 2017 and has commenced construction in Q2 2017 of a gas plant with 15 MMcf/d of operational capacity, with expected first gas production in the first quarter of 2018.

The Company is also developing the drilling program to meet work commitments for the extension and plans to drill two additional development wells (Moftinu-1003 and 1004) with a potential third well in 2018. The Corporation sees potential production from these wells being able to bring the gas plant to full capacity in late 2018.

In Tunisia, the Company’s plans to focus on carrying out low cost incremental work programs to increase production from existing wells, including the Sabria N-2 re-entry and installing artificial lift on another Sabria well, are dependent on resolution of the social issues in Tunisia and the Company being able to restart production in a safe and sustainable environment. The Corporation views Sabria as a large development opportunity longer term.

Production volumes decreased in the second quarter to 329 boe/d, as compared to 1,206 boe/d in the comparable period of 2016. In Q2 2017, the decrease in production is attributable to the shut-in of the Chouech Es Saida field since February 28, 2017 and the Sabria field since May 22, 2017. The shut-in of these fields was due to social unrest in southern Tunisia that has stopped all oil & gas production in the region.

Full production in Tunisia for 2017 is dependent on the successful resolution of the social unrest in southern Tunisia and the associated security and safety issues this unrest has created.

Supporting Documents

The full Management Discussion and Analysis (“MD&A”) and Financial Statements have been filed in English on www.sedar.com and in Polish and English via the ESPI system, and will also be available on www.serinusenergy.com.

Abbreviations

| bbl | Barrel(s) | bbl/d | Barrels per day |

| boe | Barrels of Oil Equivalent | boe/d | Barrels of Oil Equivalent per day |

| Mcf | Thousand Cubic Feet | Mcf/d | Thousand Cubic Feet per day |

| MMcf | Million Cubic Feet | MMcf/d | Million Cubic Feet per day |

| Mcfe | Thousand Cubic Feet Equivalent | Mcfe/d | Thousand Cubic Feet Equivalent per day |

| MMcfe | Million Cubic Feet Equivalent | MMcfe/d | Million Cubic Feet Equivalent per day |

| Mboe | Thousand boe | Bcf | Billion Cubic Feet |

| MMboe | Million boe | Mcm | Thousand Cubic Metres |

| CAD | Canadian Dollar | USD | U.S. Dollar |

Cautionary Statement:

BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

About Serinus

Serinus is an international upstream oil and gas exploration and production company that owns and operates projects in Tunisia and Romania.

For further information, please refer to the Serinus website (www.serinusenergy.com) or contact the following:

| Serinus Energy Inc.

Calvin Brackman Director, External Relations Tel.: +1-403-264-8877 |

Serinus Energy Inc.

Jeffrey Auld Chief Executive Officer Tel.: +1-403-264-8877 |

Translation: This news release has been translated into Polish from the English original.

Forward-looking Statements This release may contain forward-looking statements made as of the date of this announcement with respect to future activities that either are not or may not be historical facts. Although the Company believes that its expectations reflected in the forward-looking statements are reasonable as of the date hereof, any potential results suggested by such statements involve risk and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Various factors that could impair or prevent the Company from completing the expected activities on its projects include that the Company’s projects experience technical and mechanical problems, there are changes in product prices, failure to obtain regulatory approvals, the state of the national or international monetary, oil and gas, financial , political and economic markets in the jurisdictions where the Company operates and other risks not anticipated by the Company or disclosed in the Company’s published material. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties and actual results may vary materially from those expressed in the forward-looking statement. The Company undertakes no obligation to revise or update any forward-looking statements in this announcement to reflect events or circumstances after the date of this announcement, unless required by law.