Serinus Energy Inc. (“Serinus”, “SEN” or the “Company”) (TSX:SEN, WSE:SEN), is pleased to report the results of the year-end evaluation of its oil and gas reserves. The evaluation was prepared by RPS Energy Canada Ltd. (“RPS”) in accordance with Canadian National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities, and includes the reserves in Serinus’ Ukraine licences, and in its Tunisian properties. RPS also assigned contingent resources to the Company’s Satu Mare licence in Romania

All of the reserves volumes as well as the net present values attributed to the Ukraine Reserves disclosed herein, refer to Serinus’ 70% effective ownership interest in the assets through its 70% indirect ownership in KUB-Gas LLC (“KUB-Gas”), which owns and operates the six licence areas in northeast Ukraine. For the Total Company figures, those aggregate values are also based on 70% interest in the Ukraine assets. Note that the Company sold all of its interests in Ukraine subsequent to December 31, 2015.

2015 2014Company Reserves – Using Forecast Prices

Oil/Liquids Gas BOE Oil/Liquids Gas BOE YoY Change

(Mbbl) (MMcf) (Mboe) (Mbbl) (MMcf) (Mboe) (%)

| Tunisia | ||||||||

| Proved

Producing |

1,468 |

2,578 |

1,897 |

1,602 |

3,059 |

2,112 |

-10% |

|

| Non-Producing | 301 | 1,337 | 524 | 402 | 1,740 | 692 | -24% | |

| Undeveloped | 848 | 1,806 | 1,150 | 1,066 | 2,478 | 1,478 | -22% | |

| Total Proved (1P) | 2,617 | 5,722 | 3,571 | 3,070 | 7,277 | 4,283 | -17% | |

| Probable | 5,799 | 14,490 | 8,214 | 5,266 | 12,704 | 7,383 | 11% | |

| Total Proved & Probable (2P) | 8,417 | 20,212 | 11,785 | 8,336 | 19,981 | 11,666 | 1% | |

| Possible | 11,537 | 25,038 | 15,710 | 9,606 | 22,323 | 13,327 | 18% | |

| Total Proved, Probable & Possible (3P) | 19,953 | 45,250 | 27,495 | 17,942 | 42,304 | 24,993 | 10% | |

| Ukrai | ne (70% | SEN Working | Interest) | |||||

| Proved | ||||||||

| Producing | 60 | 12,878 | 2,207 | 63 | 12,452 | 2,139 | 3% | |

| Non-Producing | 20 | 4,375 | 749 | 22 | 4,296 | 738 | 2% | |

| Undeveloped | 41 | 6,342 | 1,098 | 21 | 2,800 | 488 | 125% | |

| Total Proved (1P) | 121 | 23,595 | 4,054 | 106 | 19,548 | 3,364 | 20% | |

| Probable | 135 | 16,378 | 2,864 | 215 | 25,599 | 4,482 | -36% | |

| Total Proved & Probable (2P) | 256 | 39,973 | 6,918 | 321 | 45,147 | 7,846 | -12% | |

| Possible | 260 | 20,591 | 3,692 | 359 | 28,662 | 5,136 | -28% | |

| Total Proved, Probable & Possible (3P) | 516 | 60,564 | 10,610 | 680 | 73,809 | 12,981 | -18% | |

| TOTAL | COMPANY | |||||||

| Proved

Producing |

1,528 |

15,456 |

4,104 |

1,665 |

15,512 |

4,250 |

-3% |

|

| Non-Producing | 321 | 5,712 | 1,274 | 424 | 6,036 | 1,430 | -11% | |

| Undeveloped | 889 | 8,148 | 2,247 | 1,086 | 5,278 | 1,966 | 14% | |

| Total Proved (1P) | 2,738 | 29,317 | 7,625 | 3,176 | 26,825 | 7,647 | 0% | |

| Probable | 5,934 | 30,868 | 11,078 | 5,481 | 38,303 | 11,865 | -7% | |

| Total Proved & Probable (2P) | 8,673 | 60,185 | 18,703 | 8,657 | 65,128 | 19,511 | -4% | |

| Possible | 11,797 | 45,629 | 19,402 | 9,965 | 50,985 | 18,463 | 5% | |

| Total Proved, Probable & Possible (3P) | 20,469 | 105,814 | 38,105 | 18,622 | 116,114 | 37,974 | 0% | |

Note: Serinus reports in US dollars. All dollar amounts referred to herein are in USD, unless specifically noted otherwise.

2015 was another challenging year for Serinus and the petroleum industry in general. For the industry, the continuing issue was the collapse in oil prices. The price of Brent Crude started at over

$56/bbl in early January, strengthened to above $66/bbl in May, then falling below $37/bbl by year end. During January 2016, it reached $28.55/bbl before finding some strength and has been recently trading near $40/bbl. This has reduced profitability for the entire industry, and caused significant changes in the economic value, and in some cases, the economic viability of reserves and resources.

Total corporate 1P and 3P reserves were substantially unchanged from 2014, while 2P reserves fell by 4%. Lower commodity prices and price forecasts were the dominant factor in 2015. The forecast price for Brent crude for 2016 is $44/bbl, vs. $74.64/bbl in the 2014 evaluation, and in the longer term, the new forecast only recovers to 92% of that used last year. This reduced reserves volumes due to earlier economic cut-offs, and delays some development plans. Individual fields (or countries) had other positive and negative revisions as well which are discussed below.

As in previous years, there were markedly different results between Ukraine and Tunisia, the two countries in which the Company’s reserves were located.

Tunisia

In Tunisia, 1P reserves decreased by 17%, while 2P and 3P reserves increased by 1% and 10% respectively. In addition to the effects of lower commodity prices, the revisions to reserves include:

- Future development in Sabria now contemplates the use of dual lateral horizontal These are expected to have higher IP rates and recoveries at the 1P, 2P and 3P levels, while reducing overall capital costs.

- Better than expected performance from the CS-3 and CS-7 wells.

Smaller technical revisions included:- Negative revisions to Proved Developed Producing (“PDP”) reserves for several wells that are currently awaiting workover, stimulation or other remedial measures

- a lower gas oil ratio in the Sabria Field leading to lower gas reserves

Ukraine

1P reserves in Ukraine increased by 20% and 2P and 3P reserves decreased by 12% and 18% respectively compared to year end 2014. The key influences on the Ukraine reserves were:

- Positive technical revisions due to

- the success of the R30c zone in O-11 and the subsequent addition of a new R30c location

- the installation of field compression in the Olgovskoye Field, and resultant better production performance

- a new horizontal location in the Makeevskoye

- Negative technical revisions due to:

- reduced pool volumetrics around the O-24 well

- the M-19 well watering out earlier than previously anticipated

- decline in the M20 R8 pool production performance

- Net positive economic revisions, as reductions in the nominal royalty rates from 55% to 29% for gas more than offset the effects of lower commodity prices, extending the economic life of the

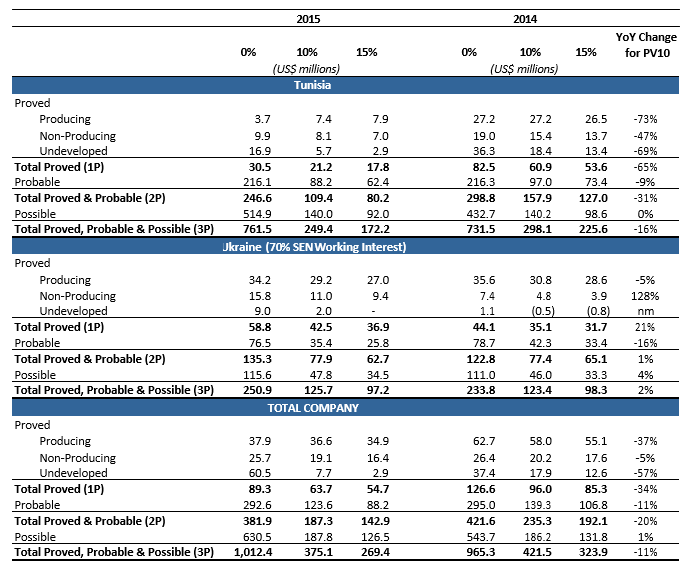

Net Present Value – After Tax, Using Forecast Prices

Net present values for Serinus’ reserves declined by 34%, 20% and 11% for 1P, 2P and 3P reserves respectively. The major contributing factors to those declines were:

- The drop in commodity prices

- The decrease in royalty rates effective January 1, 2016 on oil and gas production by the Ukraine government partially offset the effect of commodity prices

- The changes in reserve volumes as discussed above. Tunisia

The decline in oil prices significantly outweighed all other factors, even in the 2P and 3P categories which experienced net volume increases.

The drop in oil prices has an effect on Tunisian gas prices as well. In general, gas in Tunisia is priced as an equivalent to low sulphur heating oil, which in turn, will fluctuate with oil prices.

Ukraine

Serinus’ production in Ukraine was 98% natural gas, and while the drop was not as severe as that for Brent crude, the price forecast is still materially lower than that used for year end 2014. The average expected prices for 2016 and 2017 are $5.99 and $6.43/Mcf respectively, vs. $8.34 and $8.58/Mcf last year.

The more significant impact on the value of the Ukraine reserves came from the decrease in nominal natural gas royalties from 55% to 29% effective January 1, 2016. This more than offset the loss in value due to the lower commodity price forecasts in all three categories.

Contingent Resources – Romania

In addition to the 1P, 2P and 3P reserves assigned to the Company’s properties in Tunisia and Ukraine, contingent resources were also assigned to the Moftinu discovery in Romania made in early 2015. The Moftinu-1001 well tested at a maximum rate of 7.4 MMcf/d and 19 bbl/d of condensate. The currently development plan contemplates three development well and a gas plant tying into an existing sales line running through the Satu Mare concession. The resources and their net present values are shown in the table below.

| Romania – Contingent Resources | |||

| Resource Volumes (unrisked) | AT NPV (unrisked) | ||

| Oil/Liquids Gas BOE

(Mbbl) (MMcf) (Mboe) |

0% 10% 15%

($ millions) |

Probability of

Development |

|

| 1C Contingent Resources | 17.7 6,976 1,180.3 | 10.8 6.9 5.4 | 85% |

| 2C Contingent Resources | 41.8 12,632 2,147.1 | 36.7 24.5 20.2 | 85% |

| 3C Contingent Resources | 96.3 24,203 4,130.2 | 94.9 57.2 45.7 | 85% |

Pending regulatory approvals by the Romanian government and the ability to finance, first production is anticipated in early 2017 and will require $14 million of capital expenditures.

Finding and Development Costs

Total Corporate Finding and Development Costs, excluding Acquisitions

| T | otal Prove | d Reserves | Total P | roved & Pr | obable Re | serves | ||||

| 3 Year | 3 Year | |||||||||

| 2015 | 2014 | 2013 | Total | 2015 | 2014 | 2013 | Total | |||

| Exploration and Development Costs | (M$) | 18,875 | 67,453 | 75,560 | 161,888 | 18,875 | 67,453 | 75,560 | 161,888 | |

| Net Change in Future Development Costs | (M$) | 22,750 | (22,647) | 3,537 | 3,640 | 19,960 | (22,597) | 3,537 | 900 | |

| Total Finding & Development Costs | (M$) | 41,625 | 44,806 | 79,097 | 165,528 | 38,835 | 44,856 | 79,097 | 162,788 | |

| Reserve Additions (excluding acquisition) | (Mboe) | 2,189 | 1,075 | 914 | 4,178 | 709 | 978 | 1,399 | 3,087 | |

| Finding & Development Costs | ($/Boe) | $19.02 | $41.68 | $86.52 | $39.62 | $54.77 | $45.85 | $56.52 | $52.74 | |

Total Corporate Finding, Development and Acquisition Costs

| T | otal Prove | d Reserves | Total P | roved & Pr | obable Re | serves | ||||

| 3 Year | 3 Year | |||||||||

| 2015 | 2014 | 2013 | Total | 2015 | 2014 | 2013 | Total | |||

| Exploration and Development Costs | (M$) | 18,875 | 67,453 | 75,560 | 161,888 | 18,875 | 67,453 | 75,560 | 161,888 | |

| Acquisition/Disposition Costs | (M$) | – | – | 99,518 | 99,518 | – | – | 99,518 | 99,518 | |

| Net Change in Future Development Costs | (M$) | 22,750 | (22,647) | 33,437 | 33,540 | 19,960 | (22,597) | 61,177 | 58,540 | |

| Total Finding & Development Costs | (M$) | 41,625 | 44,806 | 208,515 | 294,946 | 38,835 | 44,856 | 236,255 | 319,946 | |

| Reserve Additions | (Mboe) | 2,189 | 1,075 | 4,656 | 7,920 | 709 | 978 | 12,783 | 14,471 | |

Finding & Development Costs ($/Boe) $19.02 $41.68 $44.78 $37.24 $54.77 $45.85 $18.48 $22.11

Note: Finding, Development (and Acquisition Costs) in the tables above are shown and calculated on the basis of 100% working interest in Ukraine, consistent with the consolidated financial reporting and statements.

Reserve Evaluator Price Forecasts

RPS used the following commodity price forecasts in preparing its evaluation of Serinus’ oil and gas properties.

Ukraine Tunisia Gas

| Brent | Condensate | Gas | Sabria | Chouech | |

| ($/Bbl) | ($/Bbl) | ($/Mcf) | ($/Mcf) | ($/Mcf) | |

| 2016 | 44.00 | 33.96 | 5.99 | 7.15 | 7.78 |

| 2017 | 50.00 | 38.60 | 6.43 | 8.13 | 8.84 |

| 2018 | 58.00 | 44.77 | 7.02 | 9.43 | 10.25 |

| 2019 | 65.00 | 50.17 | 7.53 | 10.57 | 11.49 |

| 2020 | 73.00 | 56.35 | 8.12 | 11.87 | 12.91 |

| 2021 | 78.00 | 60.21 | 8.49 | 12.68 | 13.79 |

| 2022 | 83.00 | 64.07 | 8.86 | 13.49 | 14.67 |

| 2023 | 88.00 | 67.93 | 9.23 | 14.30 | 15.56 |

| 2024 | 93.00 | 71.79 | 9.60 | 15.12 | 16.44 |

| 2025 | 95.61 | 73.80 | 9.79 | 15.54 | 16.90 |

| 2026 | 97.52 | 75.28 | 9.93 | 15.85 | 17.24 |

| 2027 | 99.47 | 76.78 | 10.07 | 16.17 | 17.59 |

| 2028 | 101.46 | 78.32 | 10.22 | 16.49 | 17.94 |

| 2029 | 103.49 | 79.88 | 10.37 | 16.82 | 18.30 |

| 2030 | 105.56 | 81.48 | 10.52 | 17.16 | 18.66 |

| 2031 | 107.67 | 83.11 | 10.68 | 17.50 | 19.04 |

| 2032 | 109.82 | 84.77 | 10.84 | 17.85 | 19.42 |

| 2033 | 112.02 | 86.47 | 11.00 | 18.21 | 19.80 |

| 2034 | 114.26 | 88.20 | 11.16 | 18.57 | 20.20 |

Abbreviations

| bbl | Barrel(s) | bbl/d | Barrels per day |

| boe | Barrels of Oil Equivalent | boe/d | Barrels of Oil Equivalent per day |

| Mcf | Thousand Cubic Feet | Mcf/d | Thousand Cubic Feet per day |

| MMcf | Million Cubic Feet | MMcf/d | Million Cubic Feet per day |

| Mcfe | Thousand Cubic Feet Equivalent | Mcfe/d | Thousand Cubic Feet Equivalent per day |

| MMcfe | Million Cubic Feet Equivalent | MMcfe/d | Million Cubic Feet Equivalent per day |

| Mboe | Thousand boe | Bcf | Billion Cubic Feet |

| MMboe | Million boe | Mcm | Thousand Cubic Metres |

| UAH | Ukrainian Hryvnia | USD | U.S. Dollar |

| CAD | Canadian Dollar |

Cautionary Statement:

BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Test results are not necessarily indicative of long-term performance or of ultimate recovery. The test data contained herein is considered preliminary until full pressure transient analysis is complete.

About Serinus

Serinus is an international upstream oil and gas exploration and production company that owns and operates projects in Tunisia and Romania.

For further information, please refer to the Serinus website (www.serinusenergy.com) or contact the following:

Serinus Energy Inc. – Canada

Norman W. Holton

Vice Chairman

Tel.: +1-403-264-8877

Serinus Energy Inc. – Canada Gregory M. Chornoboy Director – Capital Markets

& Corporate Development Tel: +1-403-264-8877

Serinus Energy Inc. – Poland

Jakub J. Korczak

Vice President Investor Relations & Managing Director CEE

Tel.: +48 22 414 21 00

Translation: This news release has been translated into Polish from the English original.

Forward-looking Statements This release may contain forward-looking statements made as of the date of this announcement with respect to future activities that either are not or may not be historical facts. Although the Company believes that its expectations reflected in the forward-looking statements are reasonable as of the date hereof, any potential results suggested by such statements involve risk and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Various factors that could impair or prevent the Company from completing the expected activities on its projects include that the Company’s projects experience technical and mechanical problems, there are changes in product prices, failure to obtain regulatory approvals, the state of the national or international monetary, oil and gas, financial , political and economic markets in the jurisdictions where the Company operates and other risks not anticipated by the Company or disclosed in the Company’s published material. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties and actual results may vary materially from those expressed in the forward-looking statement. The Company undertakes no obligation to revise or update any forward-looking statements in this announcement to reflect events or circumstances after the date of this announcement, unless required by law.