Serinus Energy Inc. (“Serinus”, “SEN” or the “Company”) (TSX:SEN, WSE:SEN), announces the results of the 2016 year-end evaluation of its oil and gas reserves. The evaluation was prepared by RPS Energy Canada Ltd. (“RPS”) in accordance with Canadian National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities, and includes the reserves in Serinus’ Tunisian properties. RPS also conducted a contingent resources assessment of the Company’s Satu Mare licence in Romania.

Company Reserves – Using Forecast Prices

It was another challenging year for Serinus in 2016, and the petroleum industry in general. For the industry, the continuing issue was the low relative oil prices, although the price did begin to recover towards the end of 2016. The price of Brent Crude started at just under $47/bbl in early January, quickly dropping to the yearly low of $36.25/bbl on January 20, 2016. Oil prices then begin to gradually strengthen from January to the end of June, reaching $54.28 on June 28, 2016. The prices then fluctuated between a $45/bbl-$55/bbl band to the end of November, before strengthening through December, holding at prices above $50/bbl. The yearly high oil price was reached on December 28, 2016, at $58.07/bbl. The oil price has sustained levels above $50/bbl into 2017, creating more price certainty for the industry after two years of operating in a mostly sub-$50/bbl price environment.

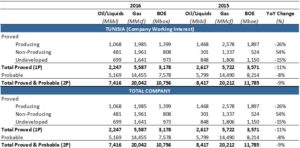

Total corporate 1P and 2P reserves decreased from 2015 by 11% and 8%, respectively. Persistent low commodity prices were the dominant factor in 2016, especially in the first half. These reduced reserves volumes are due to earlier economic cut-offs and delays in some development plans. There were positive and negative revisions which are discussed below.

Tunisia

In Tunisia, 1P reserves decreased by 11%, while 2P reserves increased by 8%. The technical revisions to reserves are:

- Positive revisions included:

- Improved performance of CS-3 well at Chouech Es Saida Field; and

- Negative revisions included:

- Brent price forecast has decreased for 2016 reserve report versus that in the 2015 reserve report, resulting in a higher economic production limit;

- 2015 YE evaluation contemplated fracture treatment of WIN-13 which has been removed from the plan;

- Decreased production performance of Sabria wells N3H, Sab-11 and NW-1;

- Decreased production performance during 2016 of CS-1 and CS-9;

- Decreased production performance of the EC-1 well on no current plan for workover; and

- Shut-in of CS-8bis due to poor production and shut-in of Sanrhar SNN-1 due to economic conditions.

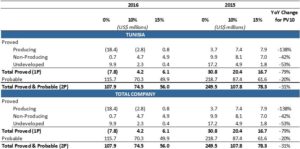

Net Present Value – After Tax, Using Forecast Prices

Net present values for Serinus’ reserves declined by 79% and 20% for 1P and 2P reserves, respectively. The contributing factors to the $16.2 million decline in the 1P PV10 valuation were:

- a lower price forecast in 2016 versus 2015 (minus $21.9 million in 2016 PV10 valuation);

- lower production volumes in 2016 versus 2015 due to higher economic production limit (minus $3.1 million in 2016 PV10 valuation);

- higher assumed abandonment costs in 2016 (minus $10.6 million in 2016 PV10 valuation);

- lower costs, royalties and taxes associated with lower production assumed in 2016 (positive $19.4 million in 2016 PV10 valuation).

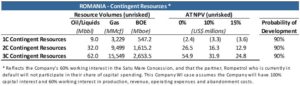

Contingent Resources – Romania

In addition to the 1P and 2P reserves assigned to the Company’s properties in Tunisia, contingent resources are also assigned to the Moftinu discovery in Romania made in early 2015.

Serinus will concentrate on the development of the Moftinu Gas Development Project in Romania which will include building surface facilities. This is a near-term project that is expected to begin producing from the gas discovery wells Moftinu-1001 and Moftinu-1000 in early 2018. The Corporation has obtained all necessary approvals for, and will soon commence, the construction of a gas plant with 15 MMcf/d of operational capacity. Construction of the project will proceed over 2017 with expected first gas from this project in Q1 2018. The Company is also developing the drilling program to meet work commitments for the extension of the Satu Mare Concession obtained on October 28, 2016.

The above valuation results reflect the Company’s 60% working interest in the Satu Mare Concession, and that the partner, Rompetrol who is currently in default will not participate in their share of capital spending. This Company WI case assumes the Company will have 100% capital interest and 60% working interest in production, revenue, operating expenses and abandonment costs. However, the Company is confident that it will be able to recover the full revenue through the project joint accounts.

Reserve Evaluator Price Forecasts

RPS used the following commodity price forecasts in preparing its evaluation of Serinus’ oil and gas properties:

| Tunisia Domestic Gas | |||

| Brent | Sabria | Chouech | |

| ($/Bbl) | ($/Mcf) | ($/Mcf) | |

| 2017 | 55.00 | 5.84 | 6.15 |

| 2018 | 60.50 | 6.42 | 6.77 |

| 2019 | 62.80 | 6.67 | 7.03 |

| 2020 | 65.60 | 6.96 | 7.34 |

| 2021 | 69.70 | 7.40 | 7.80 |

| 2022 | 75.80 | 8.05 | 8.48 |

| 2023 | 79.20 | 8.41 | 8.86 |

| 2024 | 82.90 | 8.80 | 9.27 |

| 2025 | 87.87 | 9.33 | 9.83 |

| 2026 | 89.63 | 9.51 | 10.03 |

| 2027 | 91.42 | 9.70 | 10.23 |

| 2028 | 93.25 | 9.90 | 10.43 |

| 2029 | 95.12 | 10.10 | 10.64 |

| 2030 | 97.02 | 10.30 | 10.85 |

| 2031 | 98.96 | 10.50 | 11.07 |

| 2032 | 100.94 | 10.71 | 11.29 |

| 2033 | 102.96 | 10.93 | 11.52 |

| 2034 | 105.02 | 11.15 | 11.75 |

| 2035 | 107.12 | 11.37 | 11.98 |

Abbreviations

| bbl | Barrel(s) | bbl/d | Barrels per day |

| boe | Barrels of Oil Equivalent | boe/d | Barrels of Oil Equivalent per day |

| Mcf | Thousand Cubic Feet | Mcf/d | Thousand Cubic Feet per day |

| MMcf | Million Cubic Feet | MMcf/d | Million Cubic Feet per day |

| Mcfe | Thousand Cubic Feet Equivalent | Mcfe/d | Thousand Cubic Feet Equivalent per day |

| MMcfe | Million Cubic Feet Equivalent | MMcfe/d | Million Cubic Feet Equivalent per day |

| Mboe | Thousand boe | Bcf | Billion Cubic Feet |

| MMboe | Million boe | Mcm | Thousand Cubic Metres |

| UAH | Ukrainian Hryvnia | USD | U.S. Dollar |

| CAD | Canadian Dollar |

Cautionary Statement:

BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Test results are not necessarily indicative of long-term performance or of ultimate recovery. The test data contained herein is considered preliminary until full pressure transient analysis is complete.

About Serinus

Serinus is an international upstream oil and gas exploration and production company that owns and operates projects in Tunisia and Romania.

For further information, please refer to the Serinus website (www.serinusenergy.com) or contact the following:

| Serinus Energy Inc.

Calvin Brackman Director, External Relations Tel.: +1-403-264-8877 |

Serinus Energy Inc.

Jeffrey Auld Chief Executive Officer Tel.: +1-403-264-8877 |

Translation: This news release has been translated into Polish from the English original.

Forward-looking Statements This release may contain forward-looking statements made as of the date of this announcement with respect to future activities that either are not or may not be historical facts. Although the Company believes that its expectations reflected in the forward-looking statements are reasonable as of the date hereof, any potential results suggested by such statements involve risk and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Various factors that could impair or prevent the Company from completing the expected activities on its projects include that the Company’s projects experience technical and mechanical problems, there are changes in product prices, failure to obtain regulatory approvals, the state of the national or international monetary, oil and gas, financial , political and economic markets in the jurisdictions where the Company operates and other risks not anticipated by the Company or disclosed in the Company’s published material. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties and actual results may vary materially from those expressed in the forward-looking statement. The Company undertakes no obligation to revise or update any forward-looking statements in this announcement to reflect events or circumstances after the date of this announcement, unless required by law.